Time Value Of Money

The time value of money matters because as the basis of western finance you will use it in your daily consumer business and banking decision making.

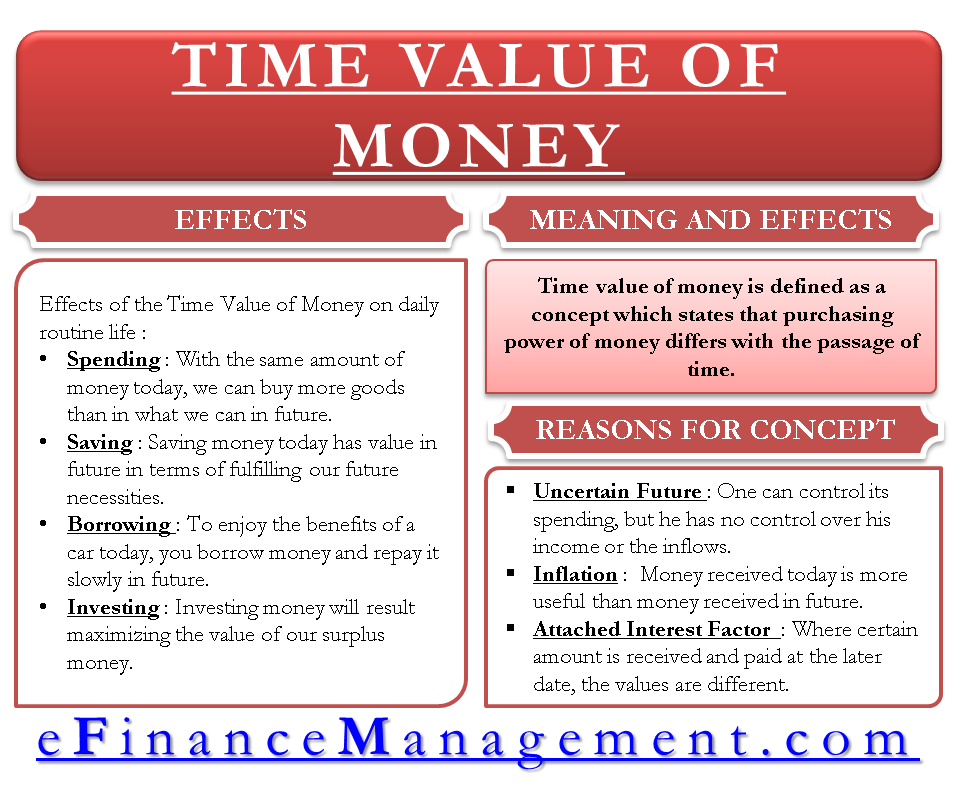

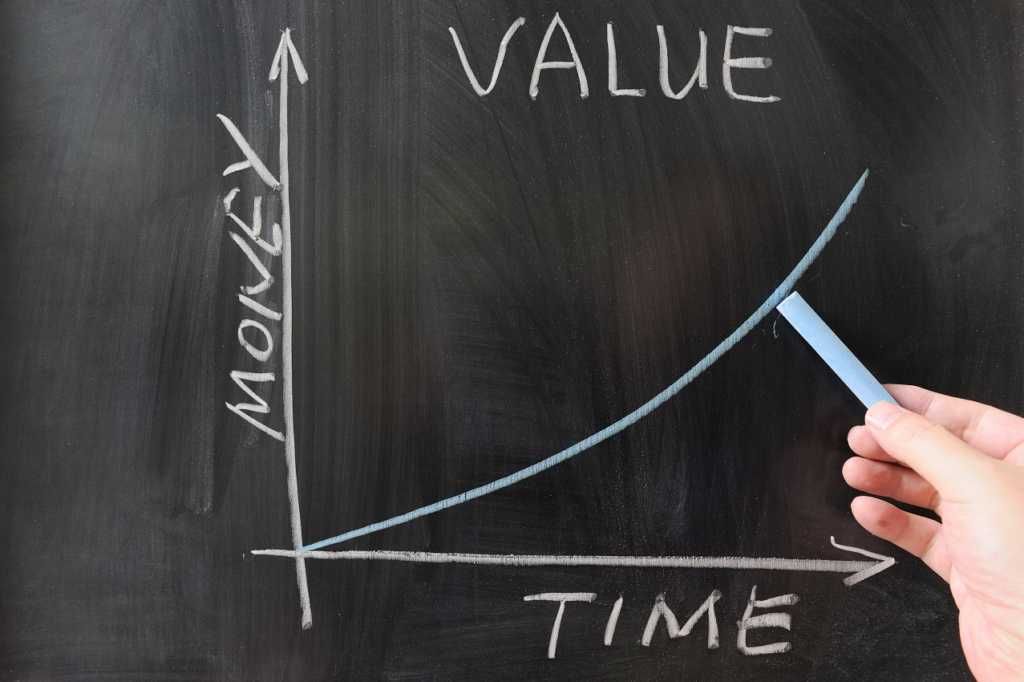

Time value of money. Time value of money. It is founded on time preference. This is true because money that you have right now can be invested and earn a return thus creating a larger amount of money in the future. The time value of money is the widely accepted conjecture that there is greater benefit to receiving a sum of money now rather than an identical sum later.

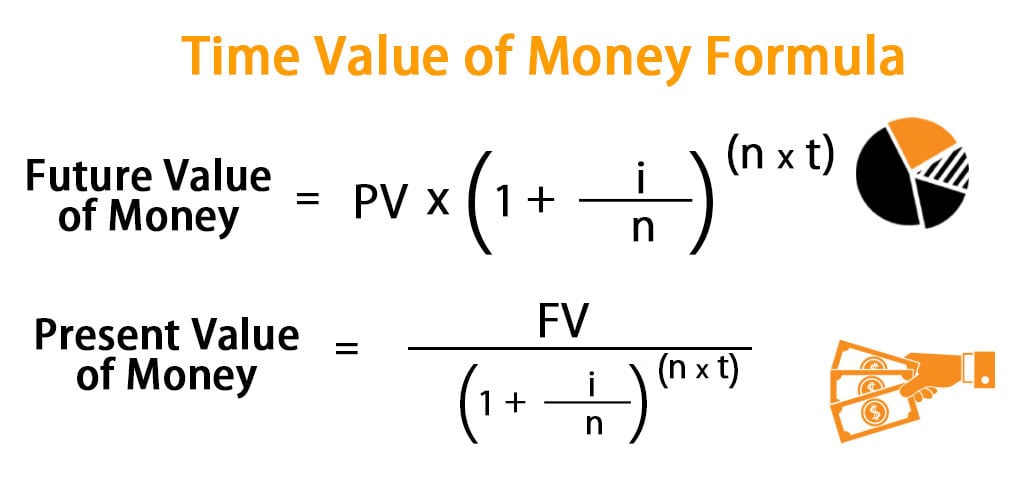

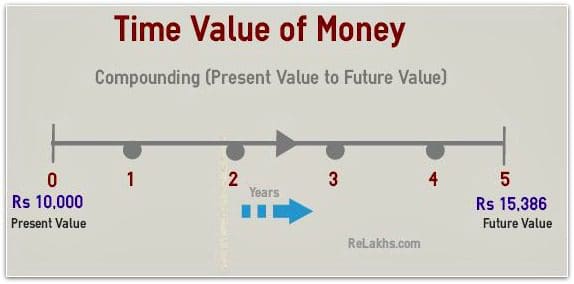

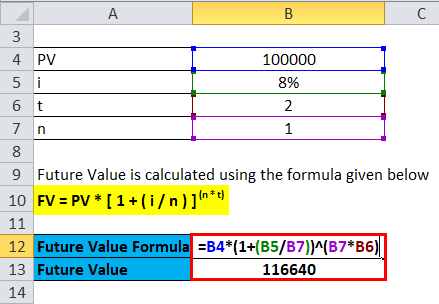

The time value of money means your dollar today is worth more than your dollar tomorrow because of inflation. Time value of money tvm means that money received in present is of higher worth than money to be received in the future as money received now can be invested and it can generate cash flows to enterprise in future in the way of interest or from investment appreciation in the future and from reinvestment. For most of us taking the money in the present is just plain instinctive. Also find out how long and how much you need to invest to reach your goal.

The time value of money is a basic financial concept that holds that money in the present is worth more than the same sum of money to be received in the future. All of these systems are driven by the idea. The underlying principle is that a dollar in your hand today is worth more than a dollar you will receive in the future. Calculate the present and future values of your money with our easy to use tool.

Time value of money is one of the most basic fundamentals in all of finance. For example if you can get 10 000 now or in 5 years you d choose to get them now all other things being equal. Risk and return say that if you are to risk a dollar you expect gains of more than just your dollar back. This core principle of finance holds.

So at the most basic level the time value of money demonstrates that all things being equal it seems better to have. Inflation increases prices over time and decreases your dollar s spending power.