Time Value Of Money Calculator Excel

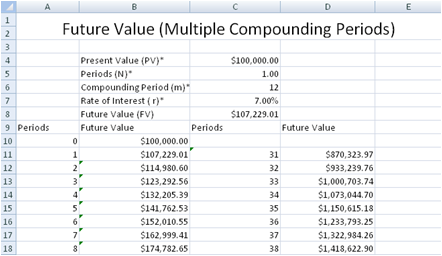

10000 1 4 5 which gives the result 12166 52902.

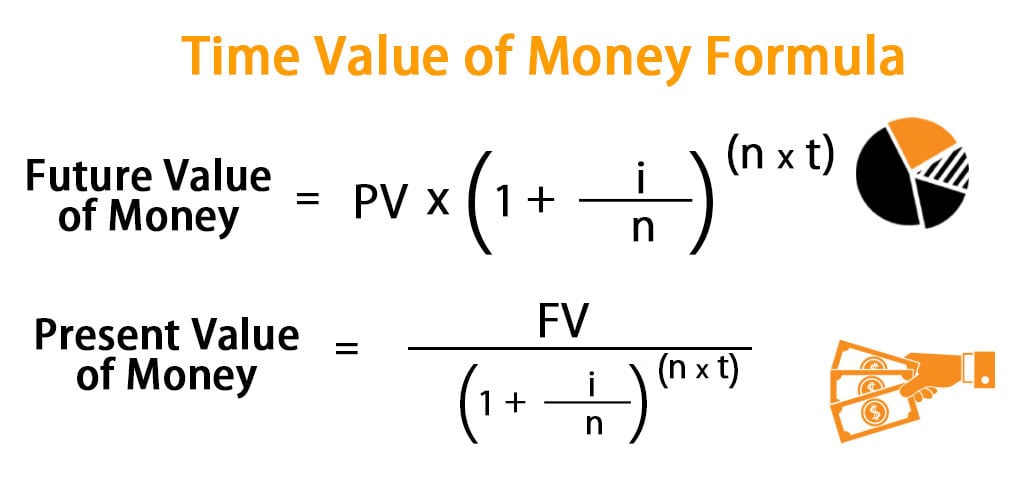

Time value of money calculator excel. The time value of money and discounted cash flow analysis are two cornerstone concepts of investment and financial analysis. 5 ways of using excel as a time value of money calculator pv. Once you insert the three arguments in the function excel will display the present value. Future value is calculated using the formula given below fv pv 1 i n n t.

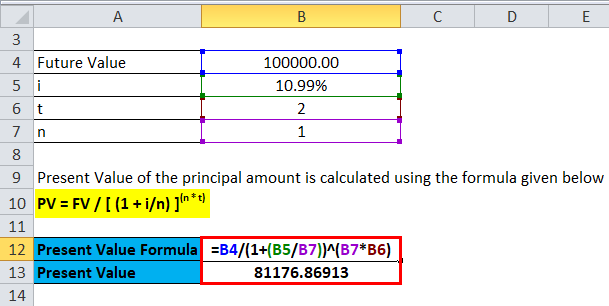

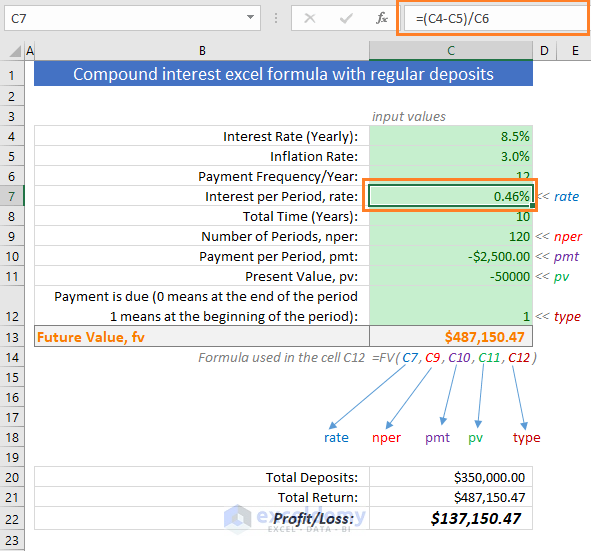

1 the present value of money. Here you will have to divide. Your client desires to have a retirement account balance of 2 million in 25 years. Pv d9 12 d10 12 d11.

The periodic payments are paid monthly so the interest rate should also be monthly. For example if an investment of 10 000 earns an annual interest rate of 4 the investment s future value after 5 years can be calculated by typing the following formula into any excel cell. Mayes financial calculator tutorials and much more. Excel and other spreadsheet programs is the greatest financial calculator ever made there is more of a learning curve than a regular financial calculator but it is much more powerful.

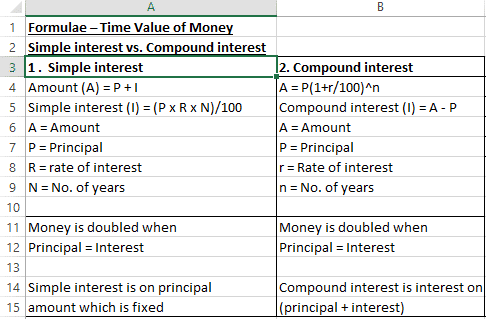

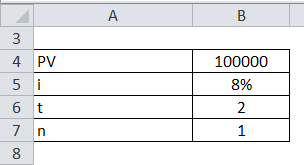

Calculating annual and monthly interest rates. Here pv is 100 000 rate of interest for 6 months applicable is 3 50 p a number of years is 0 5 1 2 and the number of compounding per period will be 2. Time value function rate the rate function in excel enables you to calculate the annual rate of return or interest rate related to a time value of money scenario. Examples a and b.

The future value of the investment rounded to 2 decimal places is 12 166 53. This tutorial will demonstrate how to use excel s financial functions to handle basic time value of money problems using the same examples as in the calculator tutorials. The investment rate is the discounting rate or the hurdle rate. Present value is the value today of an amount that is receivable in the future with the investment rate for the period of time.

Time value of money formula excel. 2 future value of money. Pv present value formula. The aim of this free investment financial calculator and tutorial is to introduce these two concepts and at the same time use microsoft excel to develop financial models that utilize these concepts for analyzing investments.

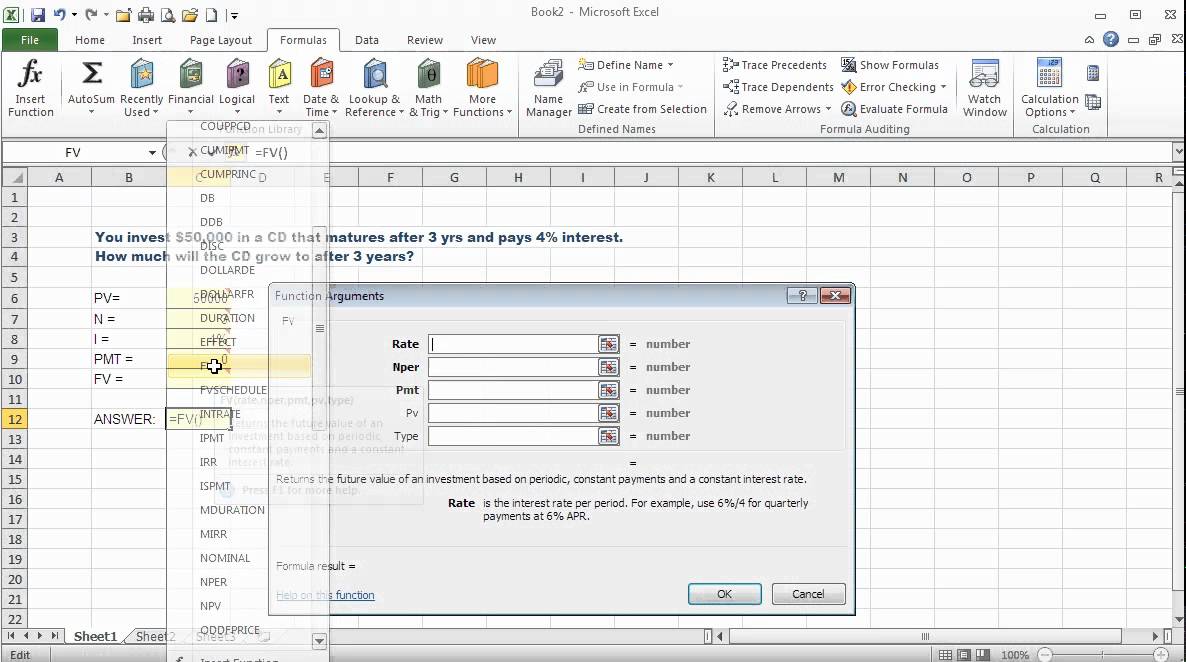

We can calculate it by using the technique of discounting. Let s now try to calculate the future value of money. Firstly you need to know more about some microsoft excel s functions like. The client plans on making monthly deposits of 1 500 and would like to know the annual return required to reach her goal.